Maros - Torda vármegye térkép 1899 (2), atlasz, Gönczy Pál, 24 x 30, Magyarország, megye, járás - Térkép, atlasz, földgömb | Galéria Savaria online piactér - Vásároljon vagy hirdessen megbízható, színvonalas felületen!

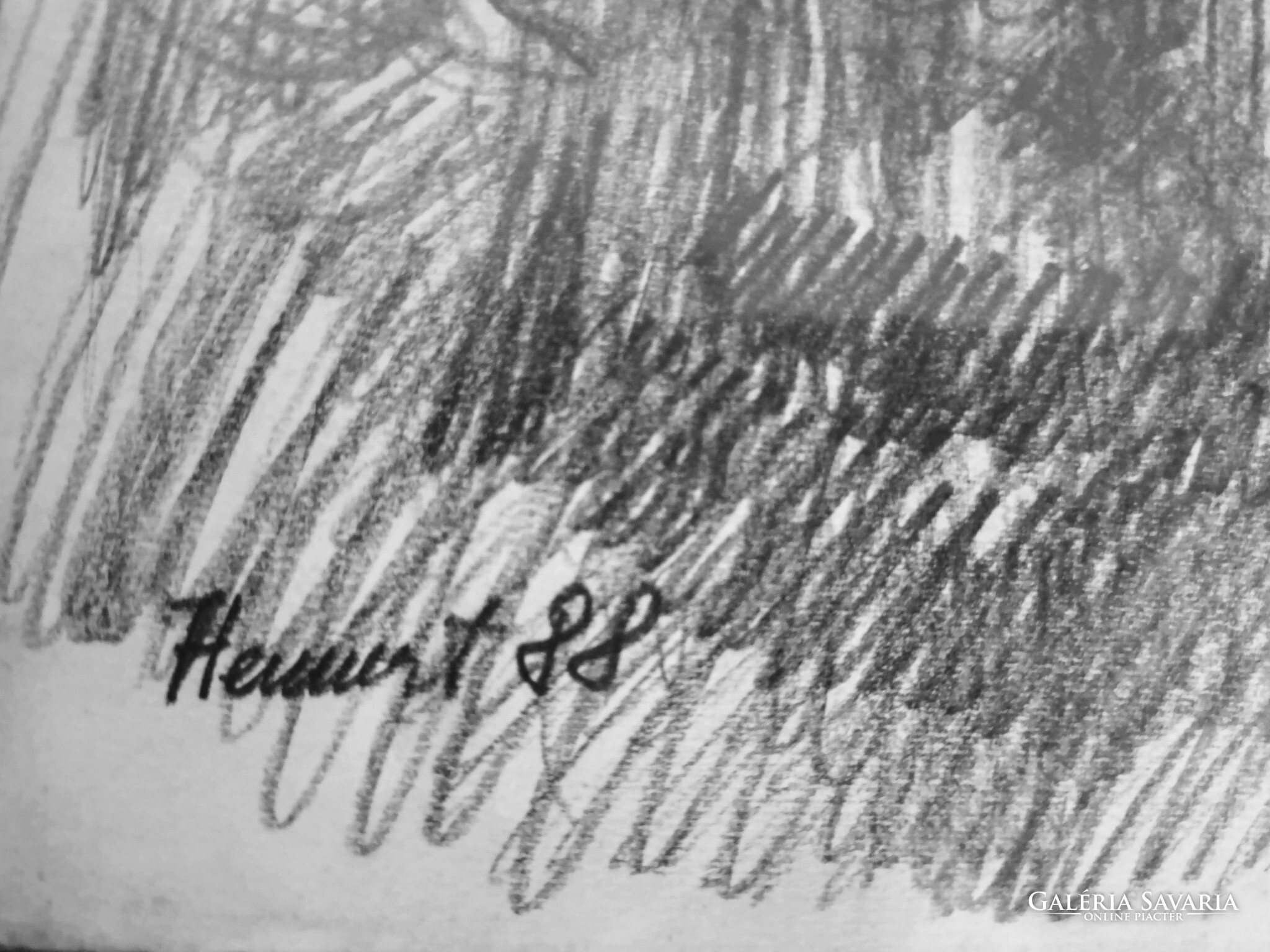

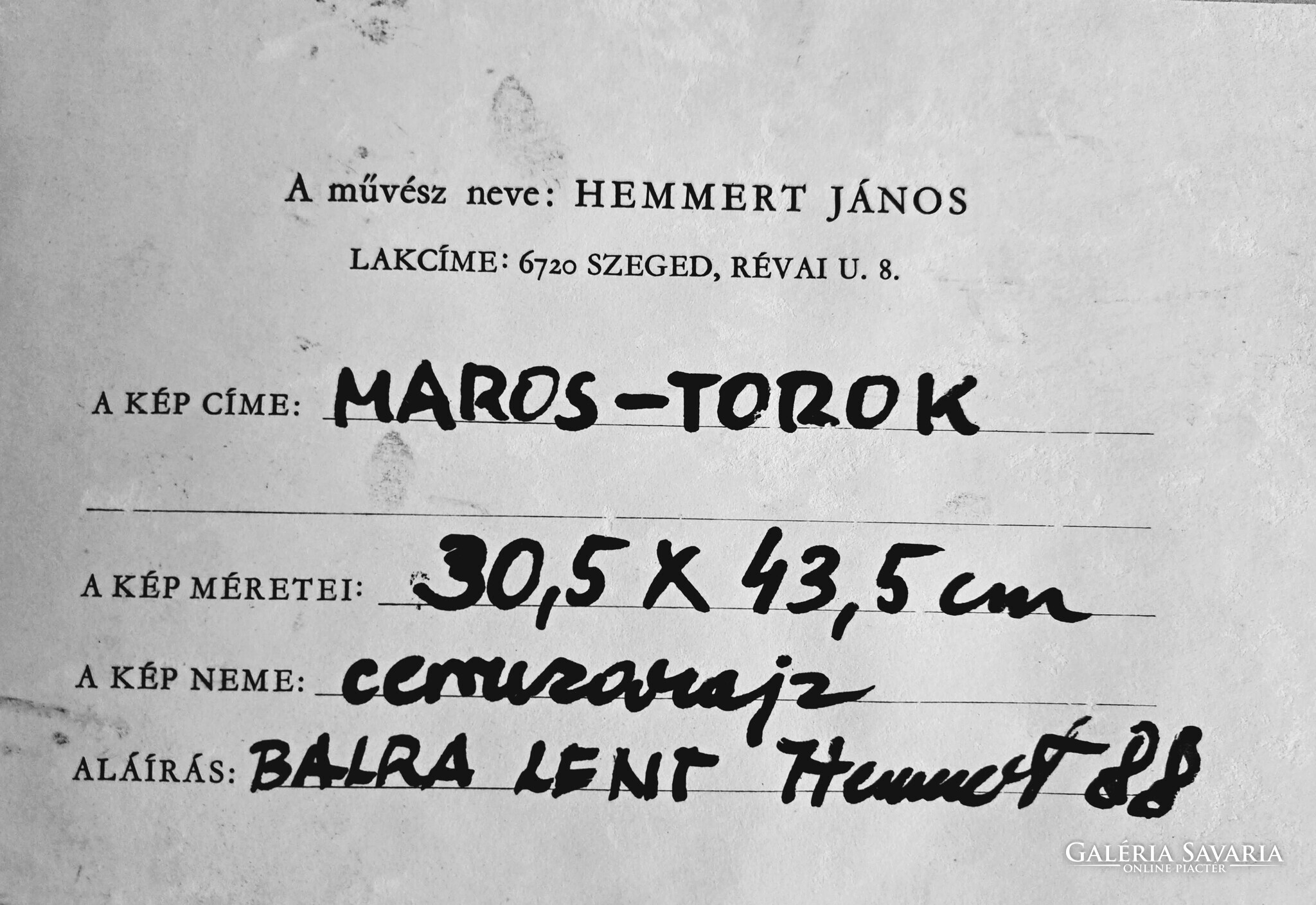

Hemmert János: MAROS-TOROK - Kép, grafika | Galéria Savaria online piactér - Vásároljon vagy hirdessen megbízható, színvonalas felületen!

Hemmert János: MAROS-TOROK - Kép, grafika | Galéria Savaria online piactér - Vásároljon vagy hirdessen megbízható, színvonalas felületen!